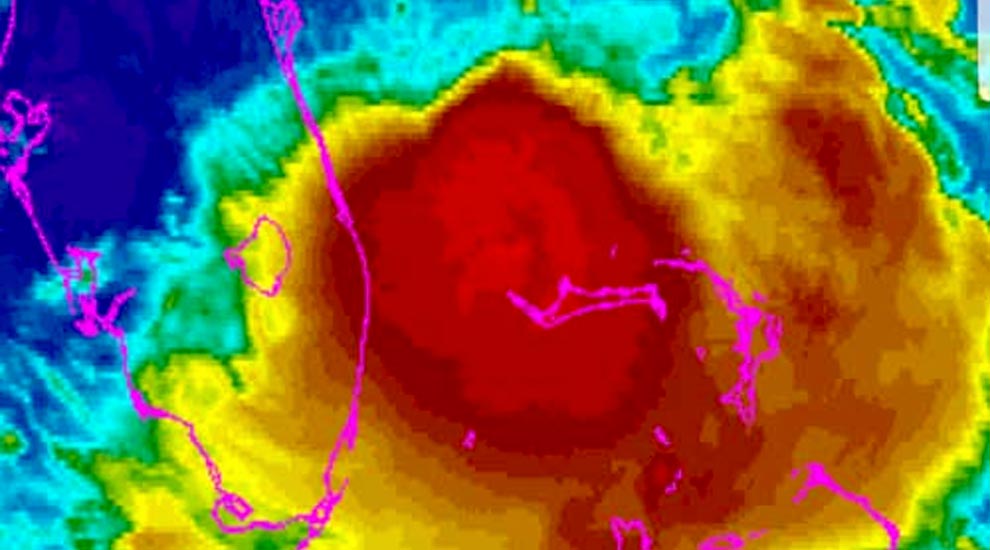

The 2021 Hurricane Season in Florida

Summer is here, and the weather is getting warmer. For residents of the Eastern or Southern coasts of the United States, that means hurricane season is on the way. Property owners that live along the coast know that hurricanes are part of life, and there’s not much they can do to avoid a big storm.

But smart property owners also know they can prepare for the worst. Part of that preparation is having the materials on hand to ensure their property stays intact and as dry as possible during a big storm. Just as vital to that process is taking a look at their insurance coverage in case they need to make a homeowners insurance claim, and working with public adjusters before they file anything.

What does the 2021 hurricane season look like? Here’s a preview for property owners that will help them plan for their coming year. Knowing what’s coming could mean the difference between looking forward to summer with confidence and spending the warm days worrying about the next big storm.

Hurricane Season Is Getting Longer and Stronger

Before we get to the specifics of this year’s forecast let’s address the elephant in the room. If you grew up on the coast it’s become clear that as time has gone by, hurricane season has slowly been getting longer and the storms stronger.

It really doesn’t matter why it’s happening, it’s enough to know that scientists know that it’s happening! And as hurricanes get stronger and more frequent storm damage property owners might need to put more heft in their insurance policies.

In 2020, there were a record-breaking 30 named storms during the hurricane season. 13 of those became hurricanes with top winds of 74 miles per hour or greater. And six of those became major hurricanes with winds topping out at 110 miles per hour or greater.

Florida is the most prone state to hurricanes, experiencing at least 40% of hurricanes throughout the country. Florida has also been hit by more than twice as many hurricanes as the next closest hurricane-prone state, which is Texas.

For anyone with an eye for the bottom line, all those storms did an estimated 60 to 65 billion dollars worth of damage across the United States. And with that kind of money being thrown around it’s just smart for homeowners to take a look at their policies to make sure they’re covered, to consider a public adjuster to help with filing their claim when bad things happen.

What Is A Normal Hurricane Season?

Before we get too far into the weeds it makes sense to understand what a normal hurricane season looks like. The National Oceanic and Atmospheric Administration (NOAA) is in charge of setting these standards. They say on average there are about 10 named storms every year, about six of those will become hurricanes and less than three will become major hurricanes.

Looking back at least year monster storm season an ‘average’ year looks easily manageable. A property owner might be well covered for an average year but like we said, ‘average’ doesn’t exist anymore so they should be checking their coverages now.

2021 Hurricane Season

This year’s hurricane season looks like it might be another wild ride. NOAA recently put out this year’s forecast in May and their predictions look a bit ominous.

NOAA says there’s a 60 percent chance of an above-normal hurricane season. That statistic should be enough to urge anyone to take a look at their insurance coverage to make sure they’re covered. And if there are a lot of claims it might make sense to get a public adjuster on your side in the worst cases scenario.

The good news is that NOAA says 2021 shouldn’t be quite as bad as last year. They’re calling for between 13 to 20 named storms. Of those they expect between 6 to 10 to become hurricanes and only 3-5 to become full-blown major hurricanes.

So not as bad as 2021, but still way worse than average. So what can a homeowner do to make sure they’re safe.

Physical and Financial Preparation

When a hurricane slams into a coastal neighborhood what causes the most damage? Most people will say it’s high winds and those dramatic images of flyaway roofing and flapping street signs that wreak the most havoc. But that’s not necessarily the case.

In reality, it’s always the water. Inland flooding, powerful storm surges, and days of post-storm standing water are going to be the biggest problems when the hurricane hits. Here’s a quick little statistic to put things in perspective: one cubic foot of water weighs 62 pounds. Imagine how much of a punch that much water is going to have when it gets pushed onshore by winds that are sometimes blowing at hundreds of miles an hour.

Here are a few things to take away from this little science lesson: just a few cubic feet of water is going to weigh more than most humans so stay far away from fast-moving water. If authorities say it’s time to evacuate, comply.

If there’s time before leaving, homeowners can get as much as they can off the lower floors of their homes. That won’t save the carpet, but it might save a good bit of furniture. The same goes for boarding windows. Anything to slow down that wall of water is going to save you money after the storm.

Also, if when it comes to insurance coverage it’s a safe bet to put a fair amount of money into water damage coverage. Replacing a roof is one thing, replacing everything that got wet, and moldy, and destroyed after the roof got blown away is likely going to dwarf that cost.

We’re Here To Help

At Platinum Public Adjusters we’re in the business of making sure you’re prepared for the 2021 Hurricane Season and what comes after. We’re here to work with homeowners before they make any homeowners insurance claims to make sure they get the kinds of payouts they need to get back on their feet in the aftermath of even the worst storm.

Our team of public adjusters will work with property owners in the aftermath of a storm and negotiate with their insurance companies to ensure the maximum payout.

And we’re located in Miami, Florida so we know a thing or two about hurricanes. Don’t hesitate to check out our website or call for a free consultation. We’re here to help!