Mold Damage Public Adjusters

Miami and Surrounding Areas

Residential and Commercial Property Licensed Public Adjusters Miami

Mold Damage Claims: Know the Details

- How common is mold in Florida Homes?

- Can high humidity cause mold damage?

- Can leaks cause mold damage?

- What other factors contribute to mold?

- How common is mold in buildings?

- Is Mold removal covered by my insurance policy?

- Is there more than one type of mold?

- What are some of the mold signs?

- How long does it take for mold to grow after water damage?

- Can Platinum Public Adjusters help me?

If you have any other questions, please don’t hesitate to contact us.

How common is mold in Florida Homes?

Mold thrives in humid climates. Florida homes are prone to it due to the year-round humidity particularly in the summer during the rainy season. This kind of damage is generally attributed to other damage including burst pipes, a leaky roof, humidity, faulty A/C, etc.

Mold thrives in humid climates. Florida homes are prone to it due to the year-round humidity particularly in the summer during the rainy season. This kind of damage is generally attributed to other damage including burst pipes, a leaky roof, humidity, faulty A/C, etc.

If left unchecked, it can cause substantial damage to your home and health. While it is often covered by insurance policies when it originates as a result of a covered peril.

- Water damaged ceiling mold

- Mold hardwood floor water damage;

- Mold in carpet from water damage

- Mold on Drywall;

- Mold on other surfaces;

Our team of highly qualified mold damage claim adjusters, will review the terms of your policy and determine the best course of action for you to receive the payments you deserve for your mold damage restoration and repairs.

If you have any other questions, please don’t hesitate to contact us.

Can high humidity cause mold damage?

Yes. High humidity is mold’s best friend. Moisture in the air finds its way into cracks, corners and crevices promoting its growth. Dehumidifiers are a great way of extracting the humidity from the air, preventing the problem before it starts.

Yes. High humidity is mold’s best friend. Moisture in the air finds its way into cracks, corners and crevices promoting its growth. Dehumidifiers are a great way of extracting the humidity from the air, preventing the problem before it starts.

If you’re unsuccessful with your insurance company, one of our licensed public adjusters will come out and review your potential insurance claim.

Can leaks cause mold damage?

Whether from your air conditioner, roof, or otherwise, whenever an area within the interior of your home is exposed to moisture for long periods, you’re at risk of growing mold. The damp areas in your home, like the kitchen, bathroom, laundry room, etc., all pose prime locations for mold growth. Our office will review your potential claim FOR FREE and take the necessary action to retain your money.

What other factors contribute to mold?

Appliances, worn door and window seals, damaged or old roofs, and exposure to moisture for long periods of time are a contributing factor in mold growth. There are damp areas in your home like: your kitchen, bathroom, etc. are all prime areas for growth.

Appliances, worn door and window seals, damaged or old roofs, and exposure to moisture for long periods of time are a contributing factor in mold growth. There are damp areas in your home like: your kitchen, bathroom, etc. are all prime areas for growth.

Platinum Public Adjusters, will review your potential claim, FOR FREE, and take the necessary action in filing your insurance claim to maximize your payout.

How common is mold in buildings?

Molds are very common in buildings and homes. It can grow in places with a lot of moisture, such as around leaks in roofs, windows, or pipes, or where there has been flooding. It also grows well on paper products, cardboard, ceiling tiles, and wood products. As well as, in dust, paints, wallpaper, insulation, drywall, carpet, fabric, and upholstery.

Does my insurance policy cover mold removal?

Home or commercial insurance mold removal depends on the cause of the damage, policy coverage and the insurance company.

Home or commercial insurance mold removal depends on the cause of the damage, policy coverage and the insurance company.

As stated, the carrier and your policy will determine coverage. A majority of providers that do offer coverage have limits.

If you have a leak and do nothing about it for some time pesky spores will begin to grow. Basically, homeowners insurance may protect you if the mold damage claim filed is part of a peril. There are exceptions. We can help you navigate the complexity of your policy.

Usually, the home or commercial insurance company will only cover what the policy lists. Fire and vandalism coverage is standard on most policies, however, additional coverage may be needed in some instances.

Is there more than one type of mold?

Yes. There are multiple types that can grow in the same area, and most of us can’t tell the difference without proper testing. It is not necessary to tell one from another to eliminate it. Below are a few of the most common you will find indoors:

Penicillium

Can be either blue, black or green. It can be found in insulation, and under carpets, particularly in the padding.

Aspergillus

This one can be white, gray with dark spots or green. It can grow in walls, attics, fabrics and dry food. A good example is bread that expires.

Cladosporium

Can be either black, green, brown or a combination. It thrives on carpet, fabrics, and A/C ducts.

What are some of the mold signs?

Mold usually starts as a small speck and can grow fast. It can be spotted early on unless it is in an area out of site. As indicated above mold come in a variety of colors and can have a fuzzy powdery look.

If you come across a spot and are unsure if it is an old stain, below are a few signs to look out for:

- A few drops of bleach lightens its color in a couple of minutes;

- It has a musty smell;

- When left uncheck it will surely continue to grow;

- There’s a near source of water or moisture, and without much light;

- Cracking, peeling or warping is another tall tail sign it may be growing.

Platinum Public Adjusters specialize in helping business owners in South Florida and Southwest Florida areas

Public Adjusters for The People

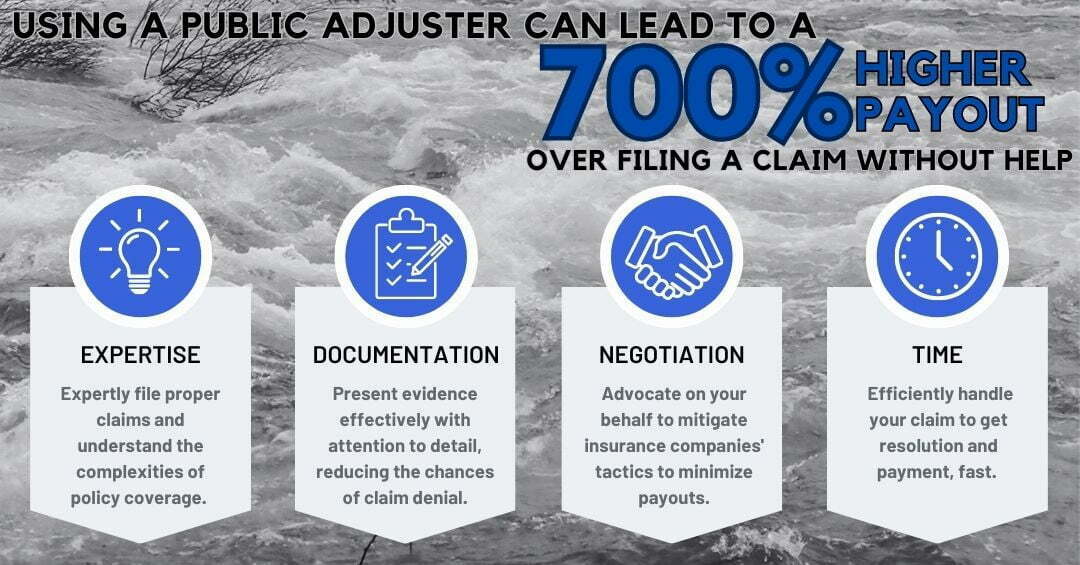

Get the maximum payout for your claim

Whether your property was severely affected by fire damage, water damage, mold damage, or has suffered storm damage, call now Platinum Public Adjusters and let us help you get your claim processed as fast as possible. We are the top Public Adjusters in Miami!