Fire Insurance Claim Adjusters

Miami and Surrounding Areas

Get your fire damage claim approved

Fire Damage Claims: Know the Details

- Why should you hire a fire insurance claims adjuster to file a fire damage claim?

- What type of fire damage is covered by homeowners insurance?

- How Long Does It Take To Settle A Fire Damage Claim?

- How Does The Fire Damage Claim Process Work?

- What Happens If My Fire Damage Claim Gets Denied?

- How To Work With Certified Insurance Public Adjusters?

- Why Platinum Public Adjusters?

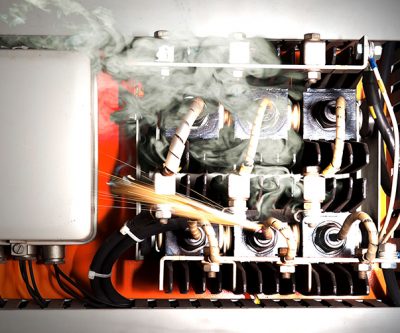

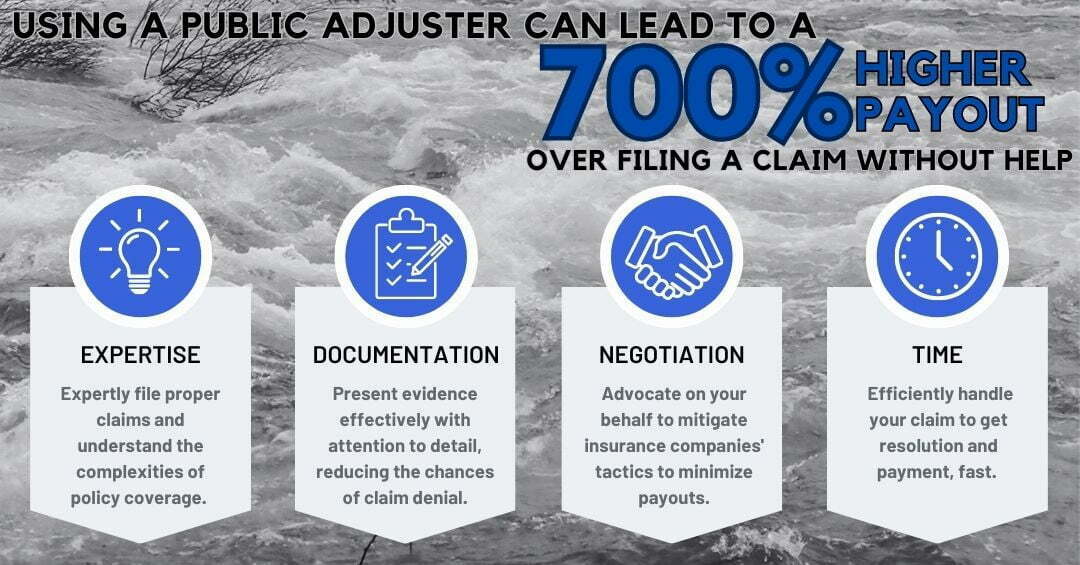

Why should you hire a fire insurance claims adjuster to file a fire damage claim?

Fire damage is typically covered by your homeowner’s insurance policy. However, properly filing a fire damage claim can be tricky. A fire claims adjuster will properly assess the damage and determine an accurate cost of repairs. This is best done by an experienced professional contractor. Hiring a contractor who is reputable and experienced adds to the already long list of to-do tasks.

This is why working with a fire claims adjuster in Miami can be beneficial. The fire claims adjuster you work with should be experienced working with fire damage claims in Florida. We work with trusted and experienced fire damage restoration services to ensure the best possible outcome for your claim. Working with an experienced Florida public adjuster, dramatically improves your chances of getting your fire damage claim approved with the highest payout.

Patricia called Platinum Public Adjusters and was able to get more for her claim after a house fire.

What type of fire damage is covered by homeowners insurance?

There are several types of properties that may be covered in the event of a fire.

Dwelling Coverage: Homeowners insurance helps cover the damage to your home or attached structures such as the garage. If your home is unlivable during repairs, your insurance policy may cover additional living expenses and other incidentals such as hotels and food.

Dwelling Coverage: Homeowners insurance helps cover the damage to your home or attached structures such as the garage. If your home is unlivable during repairs, your insurance policy may cover additional living expenses and other incidentals such as hotels and food.- Detached Structures: Some insurance policies cover structures that are not attached to your home or business such as fences, detached garages, or shed.

- Personal Property: Loss of personal property such as clothing, furniture, and appliances due to fire may also be covered under the insurance policy. If they are completely destroyed or damaged, the insurance company may even help replace them.

- Landscaping: Some homeowners insurance policies also cover damages to your trees or shrubs.

How Long Does It Take To Settle A Fire Damage Claim?

An insurance company can process and payout a settlement in as little as 90 days or less, if the claim is not denied.

Once a fire damage insurance claim is submitted, the insurance company will evaluate or investigate the cause of the fire. They investigate your claim to determine what the costs of repairs may be and determine the value of your property.

Our fire claims adjuster can review your claim and any related reports that describe the fire, the burn pattern, and the value of the damaged property. Our public insurance adjuster team, may spot additional unforeseen expenses that may be covered. This can increase the settlement amount of your fire damage claim.

How Does The Fire Damage Claim Process Work?

After an insurance claim is submitted to the insurance company, they must recognize the claim within 15 days. The insurance company has up to 40 days to approve or deny your claim.

If the insurance company accepts and approves the claim, then they have up to 30 days to reimburse you.

What Happens If My Fire Damage Claim Gets Denied?

If your claim is denied contact us right away. In Florida, you have 90-days to dispute a denied claim. Since it already takes about 90-days to get a claim approved, this can delay your repairs and compensation an extra three months. It is best to hire a fire claims adjuster or even an attorney to review and reopen your claim. The attorney can provide additional documents, numerous types of evidence, and written estimates.

How To Work With Certified Fire Claims Adjuster?

Working with Platinum Public Adjusters will give you the peace of mind to focus on other matters that need your attention.

The first order of business is to assess the fire damage and put forth a value for the claim. Our goal is to make the process as efficient and fast as possible. We begin by visiting the fire damage site to evaluate any damages. We then examine every part of the structure and investigate what has been damaged by fire, smoke damage, or water damage.

Once we have collected all the needed evidence, we prepare the complete claim in accordance with the rules of your insurance company. Every claim is supported by proper evidence in order to make sure you win the claim and get the settlement amount.

A thorough process ensures your case is strong.

Platinum Public Adjusters specialize in helping business owners in South Florida and Southwest Florida areas