Public Adjusters Contact

We are ready to help 24/7

18425 NW 2nd Ave, Suite 400 Miami Gardens, Florida 33169

Monday, Tuesday, Wednesday, Thursday, Friday, Saturday, SundayOpen 24 hours

Contact Platinum Public Adjusters

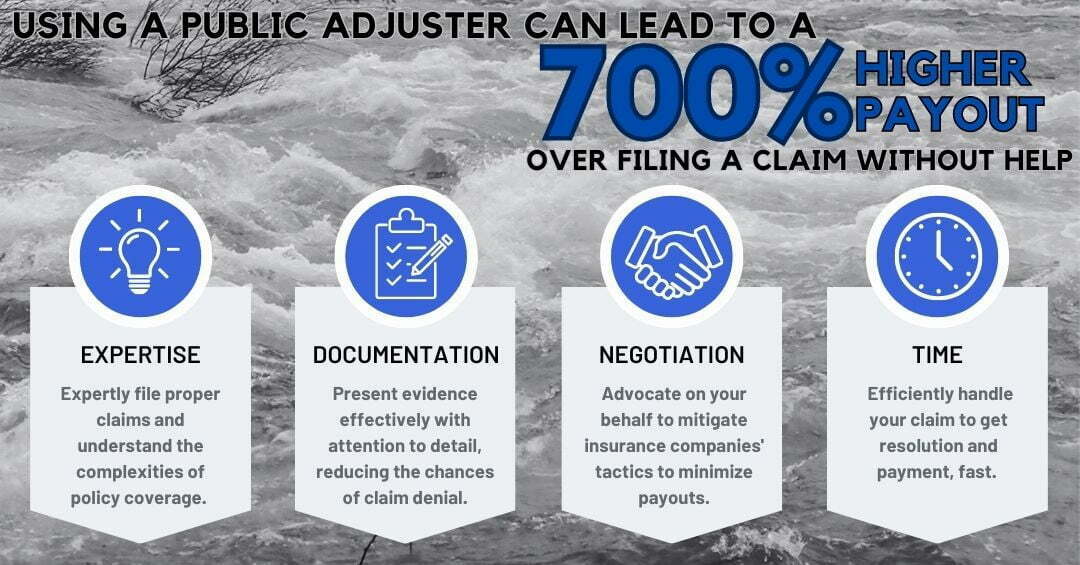

Whether you have experienced fire damage, water damage, mold damage, or wind damage, we are here to help! We will help you recover the most money for your losses.

Contact Platinum Public Adjusters 24-hours a day.

Platinum Public Adjusters specialize in helping business owners in South Florida and Southwest Florida areas