Water Damage Claims with Public Adjusters

Miami and Surrounding Areas

Residential and Commercial Property Licensed Public Adjusters

Water Damage Claims: Know the Details

- Can a loss adjuster help with filing insurance claims for roof damage?

- How do I know if I can file a cast iron broken pipe insurance claim?

- Can an insurance public adjuster help with flood damage claim?

- Does Platinum offer A/C drain leak public adjusting services?

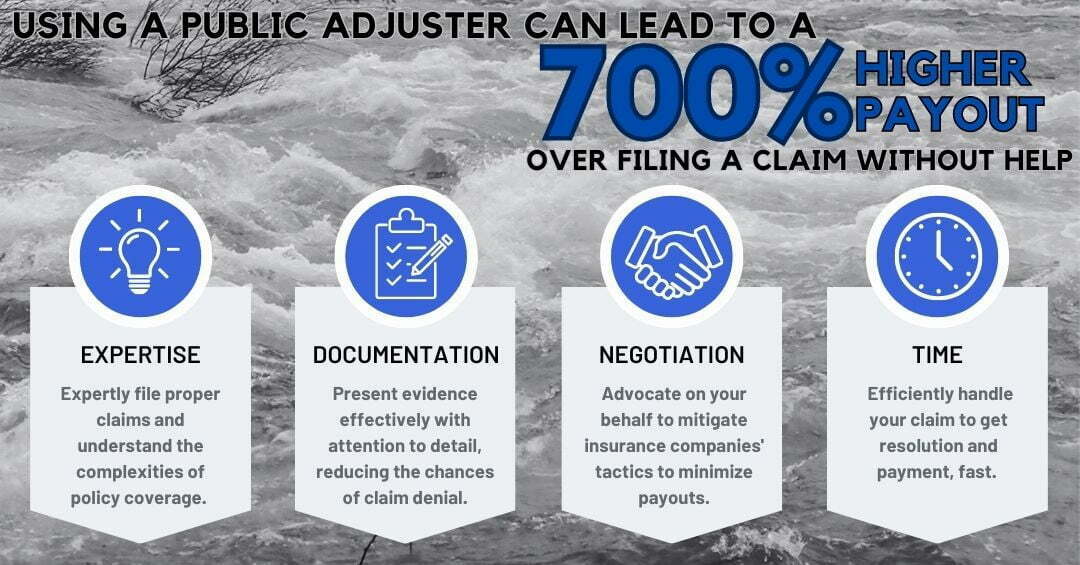

- What can Platinum Public Adjusters do for me?

FAQs for Water Damage Claims

- What types of water damage are typically covered by insurance?

- Insurance policies generally provide coverage for sudden and accidental damage. Examples of incidents that may be covered under a policy include plumbing issues, appliance leaks, burst pipes, and instances of flooding.

- What should I do immediately after discovering water damage in my home?

- Contact your insurance company as soon as possible to report the damage. Take steps to mitigate further damage, such as turning off the water source, if possible. Document the damage with photos and keep a record of any expenses incurred.

- Does insurance cover mold damage?

- While some policies may cover mold damage that results from a covered water damage event, others may have limitations. It’s crucial to understand your policy and, if necessary, add mold coverage to your insurance. Learn more about mold damage.

- What is the timeframe for filing a water damage claim, and are there any deadlines I should be aware of?

- The timeframe for filing a water damage claim can vary depending on your insurance policy. However, it’s generally advised to report the damage as soon as possible upon discovery. Many policies have specific deadlines for filing claims, and failure to adhere to these deadlines could result in the denial of your claim.

- Let Platinum Public Adjusters review your policy documents to identify specific timeframes and deadlines applicable to your situation.

- Can Platinum Public Adjusters help me understand the terms and conditions of my insurance policy related to water damage coverage?

- Water damage insurance claims are our expertise! Our local representatives can review your policy and explain the terms and conditions. This includes identifying covered perils, exclusions, limits, deductibles, and any specific requirements or obligations that must be fulfilled to ensure a successful claim payout. Platinum Public Adjusters clearly understand insurance policies for water damage and can help navigate the claims process quickly and effectively.

- What expenses can be included in the claim for water damage, and are there any limits to the coverage?

- The expenses that can be included in a water damage claim typically include the costs associated with repairing or replacing damaged property and additional living expenses if you need to relocate temporarily. Coverage limits vary by policy, and Platinum Public Adjusters will review your policy documents to understand specifics, identify eligible expenses, and ensure that you maximize your claim within the policy limits.

Water Damage Claims: Roof Damage

Can a loss adjuster help with filing insurance claims for roof damage?

Filing an insurance claim for a roof leak claim can be complicated if you do not follow the process correctly. Insurance companies are very leery of anyone filing a claim and will require accurate documentation. They typically send an insurance inspector to assess the damage. This is why having a roof adjuster on your side is critical.

The adjuster representing the insurance company is there to look out for the best interest of the insurance company. By working with a public loss adjuster, they will ensure that you have proper documentation, evidence, and may even provide their own expert inspector and do their own assessment. All of these steps can make the difference between getting your claim approved or denied, and more importantly, getting the right payout amount.

Roof leaks may develop for various reasons. Most commonly it is due to hurricanes, tropical storms, strong storms, high winds, and heavy rain. It is especially prevalent during hurricane season and Florida’s rainy season. A roof leak is usually easy to identify if you know where to look.

However, in some cases roof leaks can be hard to locate. Deterioration could be building up for years before anything appears. Spotting, staining, or cracking on your ceilings can be key identifiers of a roof issue. Roof leaks and damage is often covered by your insurance policy when peril causes the loss.

A leak is not required to file a claim. Oftentimes a strong storm can lift shingles, tiles, and other roof materials. Physical damage is often sufficient cause to file a claim.

Repairing or replacing a roof can cost a property owner thousands to hundred of thousands of dollars for a commercial property. Talk to one of our highly recommended public adjusters in Miami and don’t go at it alone.

We are licensed public adjusters!

Broken Pipes Water Damage Claims

How can I file a cast iron broken pipe insurance claim?

Replacing broken cast iron pipes is an expensive undertaking and insurance companies may attempt to undervalue or deny a claim for pipe failure, leaving the homeowner with a large out-of-pocket expense.

Insurance companies are required by law to provide an explanation for how they calculated their claim offer or if they deny a claim, they must provide an explanation of their decision. They are also legally obligated to investigate any dispute from the policyholder. Insurance policies are written with complicated legal language that can be difficult for someone to translate and interpret.

This is why working with experienced public adjusters such as Platinum can ensure that your claim is properly processed. By working with a broken pipe adjuster, you can be confident that your claim will be approved and you will get a much higher payout than doing it yourself.

Common reasons why insurers might deny homeowners insurance claims include:

- History of late or missing premium payments

- Filing for losses not included in the policy

- Lack of or incorrect evidence to support your claim

- Errors made by the adjuster from the insurance company

- Inadequate inspection of the pipes

If one is not well versed in insurance jargon, it can be easy to misinterpret your policy and it may seem as if the payout offer made by the insurance company is adequate, missing out on thousands of dollars.

The majority of homes built prior to 1975 in Florida have cast iron drain pipe. These pipes were heavily used to drain sewage for decades.The average lifespan of these pipes is around 30 to 70 years. After decades of sewage water, cast iron pipe start to corrode, rust and inevitable breakdown. These problems can be hard to detect due to hidden plumbing in utility rooms, behind walls and crawl spaces.

One common issue is clogged pipes. Many homeowners are tempted to use a chemical drain declogger. The high acidity in these chemicals can accelerate the deterioration of old cast iron pipes.

Another sign of a potential broken pipe problem may be visible in your lawn. Broken cast iron pipe can leak onto your lawn and make it abnormally healthy in a particular area. The sewage from the pipe makes a great fertilizer for your lawn, however it is not good for humans.

Insurance carriers are notorious for denying these cases. Don’t fall victim. Talk to us!

Water Damage Claims: Flood Damage

Can an insurance public adjuster help with flood damage claim?

Flooding is a temporary overflow of water onto a land that is normally dry. It is also the most common natural disaster in the United States. A vast amount of Florida is prone to it. You may not live near a body of water and still be susceptible to it.

Not always caused by heavy rainfall, it can be caused by poor drainage,coastal storms, hurricanes, tropical storms, tides, and even nearby construction projects can increase your chances of flooding. It can cause extensive damage to a properties structure, roof, electrical system and anything the water touches.

Our team of highly trained Florida public adjuster have years of experience helping property owners receive the rightful compensation for damages due to floods

What is Flood Damage?

Flood Damage Claims can be difficult to resolve. Many homeowners insurance companies do not cover flood damage. Rather, you may have to go through the NFIP or National Flood Insurance Program which is run under FEMA (Federal Emergency Management Agency).

Flood damage claims are not treated like normal homeowner claims, they have confusing guidelines that you must adhere to. When working with the government, you must be extra cautious to follow all of the rules and requirements to successfully process your claim.

This is why you need an experienced public adjusting team behind you with experience handling Flood Damage Claims in South and Southwest Florida.

Our public adjusting firm is standing by ready to help!

Water Damage Claims: A/C Leak Damage

Does Platinum offer A/C drain leak public adjusting services?

Having air conditioning in Florida is a must for your home and business. A/C systems evaporator coil cools warm air that passes over it absorbing the heat and moisture from the air. This process produces condensation. A clogged condensate drain line is one of the most common causes of water damage from an A/C unit.

If you’ve experienced subsequent water damage due to a clogged ac drain your insurance policy may cover the repairs. Platinum’s licensed public insurance adjusters will come to you and review your potential claim.

Platinum has you covered!

Platinum Public Adjusters specialize in helping business owners in South Florida and Southwest Florida areas

Public Adjusters for The People

Get the maximum payout for your claim

Whether your property was severely affected by fire damage, water damage, mold damage, or has suffered storm damage, call now Platinum Public Adjusters and let us help you get your claim processed as fast as possible. We are the top Public Adjusters in Miami!