Fire Insurance Claim Adjusters

Miami and Surrounding Areas

Get your fire damage claim approved

Fire Damage Claims: Know the Details

- Why should you hire a fire insurance claims adjuster to file a fire damage claim?

- What type of fire damage is covered by homeowners insurance?

- How Does The Fire Damage Claim Process Work?

- What Happens If My Fire Damage Claim Gets Denied?

- How To Work With Certified Insurance Public Adjusters?

- Why Platinum Public Adjusters?

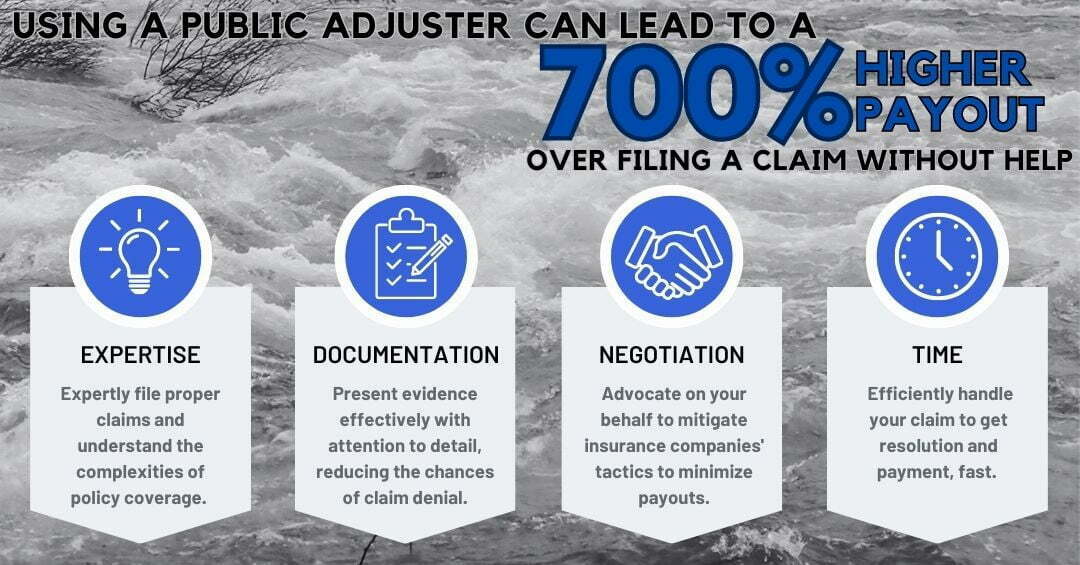

Why should you hire a fire insurance claims adjuster to file a fire damage claim?

Your homeowner’s insurance typically covers any fire damage caused to your home. However, properly filing a fire damage claim can be tricky. A public adjuster will properly assess the damage and determine an accurate cost of repairs. An experienced professional contractor best does this. Hiring a reputable and experienced contractor adds to the already long list of to-do tasks.

Working with a public adjuster in Miami can be highly beneficial. An adjuster with experience in handling fire damage claims in Florida understands the unique challenges and regulations involved. We partner with trusted and experienced fire damage restoration services to ensure your claim is managed effectively and efficiently. By collaborating with a skilled, licensed Florida public adjuster, you significantly enhance your chances of approving your fire damage claim and receiving the highest possible payout.

Patricia called Platinum Public Adjusters and was able to get more for her claim after a house fire.

What type of fire damage is covered by homeowners insurance?

There are several types of properties that may be covered in the event of a fire.

Dwelling Coverage: Homeowners insurance helps cover any damage to your home or attached structures such as the garage. If your home is unlivable during repairs, your insurance policy may cover additional living expenses and other incidentals such as hotels and food.

Dwelling Coverage: Homeowners insurance helps cover any damage to your home or attached structures such as the garage. If your home is unlivable during repairs, your insurance policy may cover additional living expenses and other incidentals such as hotels and food.- Detached Structures: Some insurance policies extend coverage to structures not directly attached to your home or business, including fences, detached garages, and sheds.

- Personal Property: The insurance policy might also cover the loss of personal property like clothing, furniture, and appliances in the event of a fire. If these items are destroyed or damaged, the insurance company may assist in replacing them.

- Landscaping: Some homeowners insurance policies also cover damages to your trees or shrubs.

How Does The Fire Damage Claim Process Work?

After submitting an insurance claim to the insurance company, they must recognize the claim within 15 days. The insurance company has up to 40 days to approve or deny your claim.

If the insurance company accepts and approves the claim, they have up to 30 days to reimburse you.

What Happens If My Fire Damage Claim Gets Denied?

If your claim is denied, contact us right away. In Florida, you have 90 days to dispute a denied claim. Since it already takes about 90 days to get a claim approved, this can delay your repairs and compensation an extra three months. Hiring a fire claims adjuster or even an attorney to review and reopen your claim is best. The attorney can provide additional documents, numerous types of evidence, and written estimates.

How To Work With Certified Fire Claims Adjuster?

Working with Platinum Public Adjusters will give you the peace of mind to focus on other matters that need your attention.

The first order of business is to assess the fire damage and put forth a value for the claim. Our goal is to make the process as efficient and fast as possible. We begin by visiting the fire damage site to evaluate any damages. We then examine every part of the structure and investigate what has been damaged by fire, smoke damage, or water damage.

Once we have collected all the needed evidence, we prepare the complete claim following your insurance company’s rule. Every claim is supported by proper evidence to make sure you win the claim and get the settlement amount.

A thorough process ensures your case is strong.

Platinum Public Adjusters specialize in helping business owners in South Florida and Southwest Florida areas