Filing A Commercial Insurance Claim

CALL NOW FOR A FREE

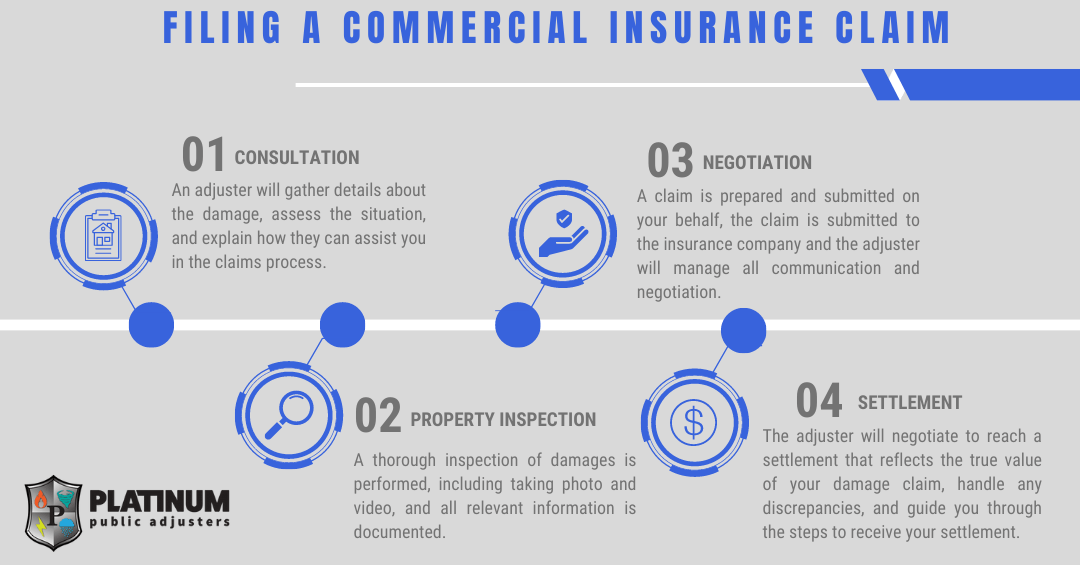

CONSULTATION

786-789-1400

24/7 (English, Español, Kreyòl)

Maximum Payout

Commercial Insurance Claims

Local Expertise, Local Care:

Public Adjuster Services In Your Community

Platinum Public Adjusters is here to serve our community by providing the following services, with ease and stress-free:

Claim Evaluation and Documentation

Platinum Public Adjusters will assess your commercial insurance policy coverage, review the extent of property damage or loss, and collect and document evidence needed for claim filing such as inspection reports, photographs, and documentation.

Claim Negotiation

Let Platinum Public Adjusters negotiate with your commercial insurance company on your behalf. All necessary information will be submitted accurately to maximize the chance of a successful claim, and discrepancies arising during the settlement process will be handled.

Maximizing Claim Settlement

With an expert understanding of insurance policies, coverage limits, and property damage valuation, Platinum Public Adjusters identify components of the claim and properly account for them in the settlement.

Representation

Acting as your advocate, Platinum Public Adjusters will communicate directly with the insurance company. They report claim details, address disputes, and negotiate with the insurance company when it matters, with your best interests in mind so that your claims case is handled fairly.

Are you a business owner that needs help with an insurance claim?

Let a local Florida public adjuster, Platinum Public Adjusters, take the reins!

Contact Platinum Public Adjusters

18425 NW 2nd Ave STE 400

Miami, Fl 33169-4528

Phone: 786-321-7982

Email: info@platinumpublicadjuster.com

As local community members, we possess in-depth knowledge of the region, ensuring accurate assessments.

As experts, we navigate the complex claims process, advocating for your rights.

As professionals, we are a dedicated team ready to handle all aspects of your claim.

As seasoned adjusters, we work with top contractors, litigators, and specialists.

Don’t settle for less, choose Platinum Public Adjusters to handle your claim.

The Negative Effects of Homeowner’s Insurance Claim Delays

Having damage to your business is an interruption, and not employing the help of a public adjuster can have several negative effects.

There is a significant cost to replacing or repairing assets, infrastructure, or equipment. Having damage to any of these items also interrupts your business, leading to downtime.

Interruptions in your normal operations can turn off existing or potential customers. Inability to meet demands or compromised quality of goods or services negatively affects your customer satisfaction.

When items needed to deliver goods or perform services are unavailable due to damage, processes are delayed, and expected delivery times aren’t met.

Having damaged infrastructure, equipment, or inventory can lead to job uncertainty among the workforce.

Fines, penalties, or legal liabilities are threats to your business when damages violate regulatory requirements or safety standards.

Swift action with a public adjuster ensures a prompt settlement with a fair maximum payout and gets your business back on its feet. Once a settlement is received, the recovery process is started, the damage is repaired, lost property and equipment is replaced, and normal operations are able to resume. In the mitigation of the financial impact of damage to your business, time is of the essence. Delayed settlements hinder cash flow and productivity. Regain momentum in your business, and contact Platinum Public Adjusters today!

Homeowner’s Insurance Policy Damage Types

Commercial Insurance Claim:

Frequently Asked Questions

Platinum Public Adjusters will represent you as the policyholder in business insurance claims, assessing property damage, preparing an insurance claim, negotiating with your insurance company, and securing a fair and maximum settlement on your behalf.

Platinum Public Adjusters will easily handle the complex aspects of the claims process due to our expert, in-depth knowledge of insurance policies, claim procedures, and property damage valuation. We’ll document your loss, estimate the repairs, negotiate with your insurance company, and dedicate our efforts to get you the compensation you are owed.

An insurance company’s adjuster works for the insurer. Hiring Platinum Public Adjusters ensures you have an adjuster that works for you, the commercial insurance policyholder.

Platinum Public Adjusters works on a contingency fee basis. Our fee is a percentage of the settlement amount you receive. The fees owed differ from claim to claim but are reasonable, considering the valuation of your claim is maximized with the help of Platinum Public Adjusters.

We help you recieve coverage for fire damage, water damage, mold damage, storm damage, theft, and vandalism. Do you have a question about what may be covered under your policy?

Read our blog article to help you decide if you need a public insurance adjuster.